Card Payment Solutions

We’ve got the payment options your business needs no matter how you take payments.

Online, face to face or by telephone, our simple payment options are what you need with NO hidden costs.

✅ Low processing costs

✅ New, modern card machines

✅ Rated EXCELLENT

Get in touch

What We Do

We combine cutting edge technology and merge them with payment processing to ensure our customers can take card payments, fast and securely at the most competitive price possible for their sector and business.

Our Approach

We wanted to make a difference in the payments industry, and we have managed to do exactly that! We are now one of the UK’s leading independent payment processing providers. We will remain at the forefront of change and will ensure that we will assist in increasing your profitability with simpliciticity in secure payments in the UK.

Our Mission

To ensure our customers take electronic payments easily and securely whilst minimising the card payment processing costs and thus maximising their profits. Payment processing for small business with first class customer service.

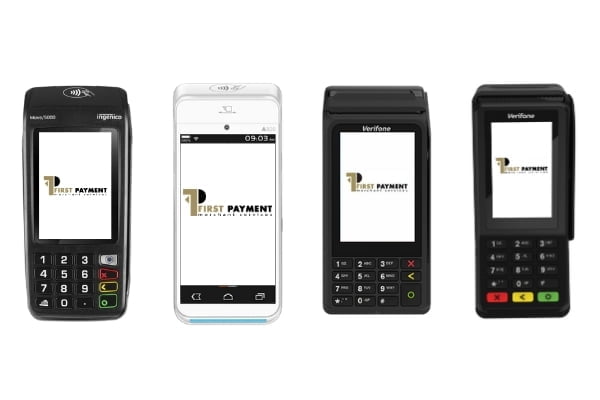

Card Machines & Payment Gateways

Whatever business you are in we can provide the best payment solution to meet your needs. Card Machines or Terminals call them what you want, these familiar payment methods come in a range of options. Simply choose the right card terminal for your business:

Countertop – Fixed at the point of sale, extremely quick, robust and simple to use. Connects directly to your phone or broadband, smart design.

Portable – Connects through WIFI or Bluetooth in your premises, small and easy to carry around, take payments at the table, great battery life.

Mobile – Take payments anywhere, uses wifi and GPRS for connection. These machines can connect to your internet and also use mobile phone signal so you can take payments on the go.

Or Pay online, Pay by phone or Pay by email.

Cutting Edge EPOS systems

As we grow our businesses in the UK we have come to realise that regardless of size an EPOS (Electronic Point of Sale) is a necessity allowing you to analyse your sales, run staff reports, execute a smooth customer service and much more. We can provide you integrated card payment processing with your till systems for a smooth customer experience with no human errors.

Stats

Card Payment Processing by First Payment Merchant Services

Growing year on year we are one of the leading card payment processing services in the UK working with leading acquiring banks.

Payments Processed

Card Payments Taken

Years Of Experience

Online Payment Gateways

Our market leading payment processing gateway allows your business to take online payments securely and simply.

Card Machines

Our terminals let you take payments at the till (fixed) Around your premises (portable) And outdoors using GPRS signal (mobile)

Business Finance

FPMS can provide an up-front cash injection for your business simply by arranging the purchase of future debit and credit card transactions. You choose the amount you need – anything from £2,500 to £300,000 based on your card takings history.

First Payment Merchant Services is proud to back UK business

When we launched in 2011 we wanted to make a difference in the payments industry and we have managed to do exactly that! We are now one of the UK’s leading independent payment processing providers.

We will remain at the forefront of change and we will ensure that we will assist in increasing your profitability with simplicity.

The First Payment Advantage

Replacement

If we cannot resolve a terminal issue over the phone we will send you a new one, we aim to send these replacements out as soon as possible to minimise any disruption.

Assistance with PCI compliance

We have dedicated helpdesks to help ensure that your business is compliant.

Payment processing is safe and secure.

Reporting

Simple summaries showing total transactions and individual transactions. Great for financial management.

Online dashboard

You can manage your card transaction history from a single online portal.

Payment processing for small business

What you see is what you get

An easy to understand charging structure with no hidden extras. No nasty surprises.

Payment processing for small business

Merchant Service Provider

First Payment Merchant Services are the go to merchant service provider in the UK. We provide your business with a merchant account which allows you to accept debit and credit card transactions in payment for goods and services. We have a range of services: merchant accounts, supporting transactions, payment gateways, payment processing, POS (point-of-sale) systems, card machines, and more.

Merchant Card Services

With a merchant account we can ensure that you’re processing safe and secure payments, and preventing fraud. How it works is simple: the account holds the payment funds whilst the customers details are checked. Then the money is securely transferred to your business bank account which can be next day, all transactions are authorised. That’s it – payment complete.

GET IN TOUCH

Success Stories

“I have been dealing with Deon for the past three years at First Payments and his service has been excellent. He is always available to assist with our 15 Papa John Franchises and made good savings for our business compared to my previous supplier. I highly recommend his service.”

“The rates and service from all has been amazing. We were also provided with an online web portal where we can see card transactions immediately as they happen in the salons. This allows us to check any shortages or errors that the salons report or we suspect instantly.

I would recommend looking into this service from FPMS for ease of operation and savings from the credit & debit card rates”

“If you are looking for top customer service and quick resolutions for your payment gateways, then I can recommend the team at First Payments highly enough. The team are always on hand to assist no matter how big or small the problem. They form an integral part of our team, working as an extension to our commercial set-up on a matchday. I can say with great certainty that the team at first payments will look after you to the best of their abilities and you’ll struggle to find a more reliable bunch”

Head Office

The Meadows Business Park

Blackwater

Camberley

GU17 9AB

Northern Office

The Atrium Building

20 Wollaton Street

Nottingham

NG1 5FW

Contact Us

SME:

0208 102 8100

Enterprise:

0208 102 8004

support@dnapaymentsgroup.com

Office Hours

Mon-Fri: 9am - 5pm

Sat-Sun: Closed